Ohio law enables property owners to claim a reduction in the taxable value of their property that has been destroyed or damaged.

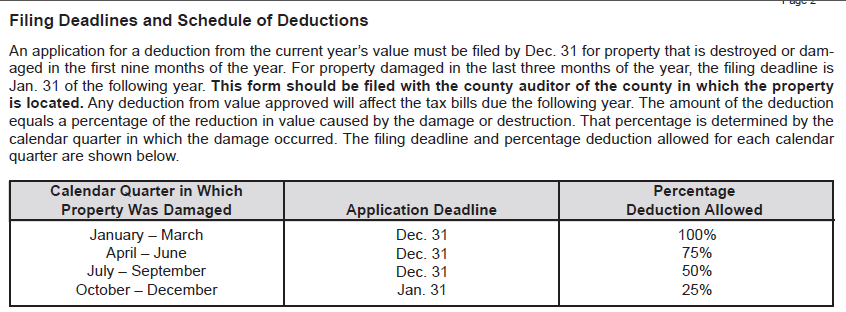

An application for a deduction from the current year’s value must be filed no later than December 31st of the current year for property that is destroyed or damaged in the first nine months of the year. For property damaged in the last three months of the year, the filing deadline is January 31st of the following year. This form is only for damage occurring in the current year. The exact date the damage occurred needs to be listed on the form.

Any deduction from value approved will affect the tax bills due the following year. The amount of deduction equals a percentage of the reduction in value caused by the damage or destruction. That percentage is determined by the calendar quarter in which the damage occurred.

For more information about Ohio Revised Code 319.38: Deductions from valuation for injured or destroyed property - Click here

MH:

REA: